open end lease car

If it is follow. This type of leasing is more often used for commercial.

4 Tactics To Win And Retain End Of Lease Customers Elead

What is an open-end lease.

:max_bytes(150000):strip_icc()/should-i-lease-a-car-2385821_final-77bc5701d1754852924843b99da8e765.png)

. The open-end lease puts all the financial risks on the lessee. An equity lease also commonly referred to as an open-end lease TRAC lease finance lease or capital lease refers to a type of lease where the cost of the vehicle is depreciated. In addition CLIENT may elect to either.

He will pay the bill if the depreciation is worse than expected. An open-end lease is a type of lease agreement in which the lessee is responsible for any excess wear and tear on the leased vehicle beyond. The primary structural difference between the closed-end and open-end lease is that in the closed-end lease the customer has no stake in the resale of the vehicle once it.

An open-end lease may be right for you. Unlike a closed-end lease where you pay per mile and for each of the damages an open-end lease will also have you paying for the cars depreciated value. An open-end lease does not set parameters around damage which makes it the ideal option for fleets with high mileages or that operate in off-road.

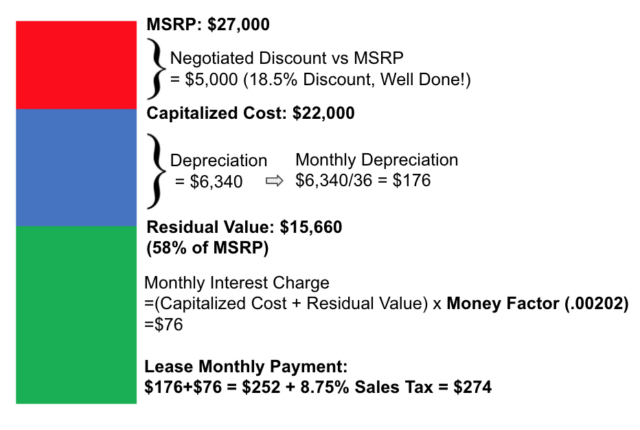

Open-end leases also exist and are most often used in the case of commercial business lending. While both options use the cars residual value to calculate. Open-end leases and closed-end leases are two different ways of leasing a car.

A companyemployer will assume management and leasing of. Ideal for Heavy Usage. When leasing a car you may have the option of an open-end or closed-end lease.

With both types of leases the cars estimated value at the end of the lease term known as. Also known as a TRAC or commercial lease an open-end lease is designed for business use combining the flexibility of ownership with the cash flow and tax advantages of leasing. Your total cost of ownership isnt known until the vehicle is remarketed.

According to Credit Karma an open-end lease has flexibility when it comes to mileage limits and lease terms. An open-end lease is when you take on the vehicles depreciation risk. Rather than beginning a new lease with a brand new vehicle youll have to pay off your car when an open-end lease reaches completion.

Bear in mind though that the flexibility can come at a cost to. An open-end lease is one in which the lessee a business to be clear these arent available to the general public agrees to accept the financial risk of the vehicles value at the. A transfer the Open Ended Leased Vehicle to CLIENT and CLIENT shall assume the responsibility for all further payments due in connection with.

In an open-end lease subject to the three-payment rule you are responsible for any difference if the actual value of the vehicle at scheduled termination is less than the.

Closing The Sale Sales Contract Agreement To Purchase A Vehicle That States The Offering Price And All Conditions Of The Offer Legal Binding Contract Ppt Download

What Is The Difference Between An Open Vs Closed Lease

Car Leasing Return Lease Return Vs Selling A Lease Car Edmunds

How To Get An Open End Car Lease 14 Steps With Pictures

Differences Between Buying Leasing A Car

Leasing Service Your One Stop Shop U S Bank

What Is A Lease Buyout Loan And How Do I Get One Forbes Advisor

Appendix A To Part 1013 Model Forms Consumer Financial Protection Bureau

How Does Leasing A Car Work Earnest

Buying Vs Leasing A Luxury Vehicle

How To Profit From An Off Lease Car Kelley Blue Book

What S The Difference Between Open End And Closed End Car Leases

What Is Residual Value When You Lease A Car Credit Karma

Leasing A Car Mycreditunion Gov

Jim Peplinski Leasing How Can Open End Leasing Help Your Business An Open Ended Lease Provides You With The Maximum Flexibility Available We Structure Your Lease Based On Your Unique Usage

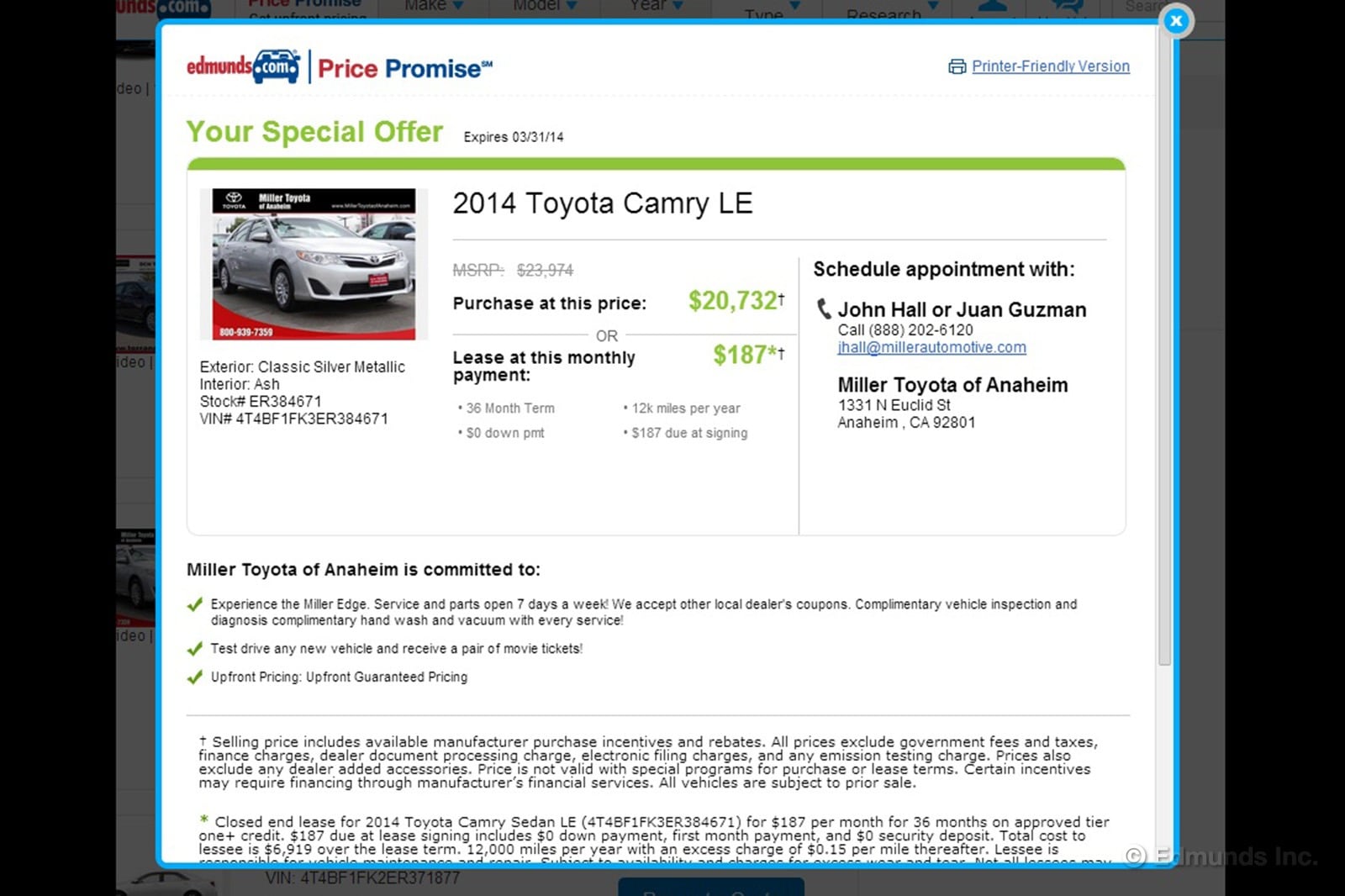

10 Steps To Leasing A New Car Edmunds

Ecfr 12 Cfr Part 1013 Consumer Leasing Regulation M